LESS BLOCKS

Less Complexity, More Profit.

Streamlining Crypto for Gains—spotting risks and high-reward cryptocurrencies and memecoins.

LESS Portfolio

- ONE [Harmony] An open blockchain with data sharding www.harmony.one/

- FTM/S [Fantom | Sonic] A thriving ecosystem www.soniclabs.com

- TLM [Alien Worlds] The #1 blockchain game on Earth! www.alienworlds.io

- SUSHI [Sushi Swap] Decentralized powerful exchange, non-custodial www.sushi.com

- CELR [Celer Network] Blockchains Connected | dApp, Asset, User www.celer.network

- GALA [Gala Games] Empowering gamers all over the world + NFT www.gala.com

- FIL [File Coin] Store and retrieve data over the internet www.filecoin.io

- Mina [Mina Protocol] Proof of Everything www.minaprotocol.com/

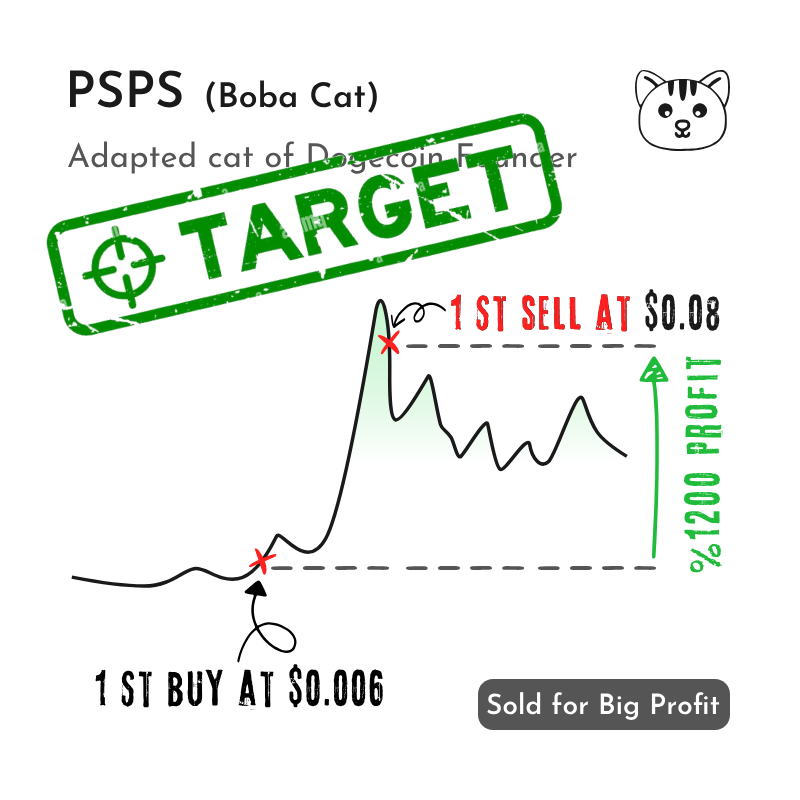

Less Memecoins

Track Shitcoin Picks

Less

Strategy

-

Tokenomics Evaluation

- Analyze the tokenomics of projects like Gala and Rio to understand their economic models and ensure they have sustainable growth strategies for long-term success.

-

Adoption & Use Case Viability

- Look for projects that solve real-world problems with clear use cases, like Celr and GTai, which are essential for ensuring widespread adoption and utility.

-

Developer Activity & Innovation

- Focus on projects with consistent developer activity and innovation, such as Phantom and Celr, as they indicate the project’s potential for future growth and adaptability.

-

Market Liquidity & Volume

- Invest in projects withenough liquidity and trading volume, such as Sushi and Gala, ensuring that assets are easily tradable and less prone to price manipulation.

-

Security & Audits

- Ensure the security and reliability of projects by assessing the quality of audits and vulnerability reports for projects like Rio, protecting investments from potential risks.

-

Market Sentiment

- Leverage real-time sentiment analysis to gauge community and investor interest in projects like Sushi, Celr, and Gala, ensuring you invest in projects with strong social backing.

-

On-Chain Data Insights

- Utilize blockchain data to identify high-volume transactions and active user engagement in projects like Sushi and Rio, signaling strong investor confidence.

-

Price Trend Analysis

- Analyze historical price trends of projects like Sushi and Gala to identify recurring patterns, potential support levels, and key resistance points, helping predict future price movements.